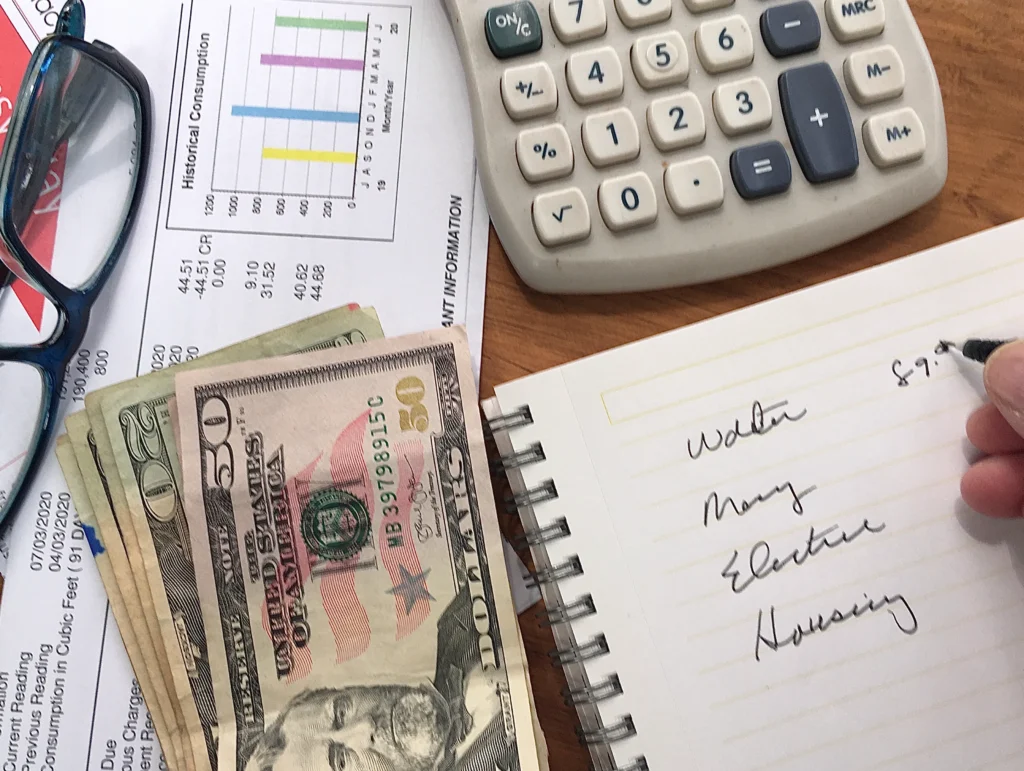

Economics and personal finance are two interconnected concepts that shape the way individuals, businesses, and governments manage money. While economics focuses on the broader study of resource allocation, production, and consumption, personal finance deals with the financial decisions individuals make to manage their money effectively. Understanding the relationship between these two fields can help individuals make informed financial choices and navigate economic changes that impact their financial well-being.

In this article, we will explore what economics is, how it influences personal finance, and why a solid grasp of economic principles is essential for financial success.

Understanding Economics: The Study of Resource Allocation

Economics is the study of how people, businesses, and governments allocate limited resources to meet their needs and wants. It examines the production, distribution, and consumption of goods and services, as well as the factors that drive economic growth and stability.

Economics is typically divided into two main branches: microeconomics and macroeconomics.

- Microeconomics focuses on individual decision-making, including how households and businesses interact in markets. It examines supply and demand, price determination, and consumer behavior.

- Macroeconomics looks at the economy as a whole, studying factors such as inflation, unemployment, economic growth, and government policies that impact national and global economies.

Both aspects of economics play a crucial role in shaping financial conditions, influencing everything from interest rates and job availability to the cost of goods and services.

The Link Between Economics and Personal Finance

Personal finance is directly influenced by economic principles, as individual financial decisions are affected by market conditions, inflation, and government policies. Understanding economic factors allows individuals to make informed choices about saving, investing, and spending.

For example, during times of economic expansion, wages tend to rise, and job opportunities increase, allowing individuals to save and invest more. Conversely, during economic downturns, job losses and inflation can impact financial security, making it essential to have an emergency fund and a well-structured financial plan.

Economic indicators, such as gross domestic product (GDP), interest rates, and inflation rates, provide valuable insights into the financial climate. Monitoring these indicators can help individuals anticipate economic changes and adjust their financial strategies accordingly.

Inflation and Its Impact on Personal Finance

Inflation, which refers to the gradual increase in the prices of goods and services over time, is one of the most critical economic factors affecting personal finance. When inflation rises, the purchasing power of money decreases, meaning that individuals need more money to buy the same goods and services.

For example, a gallon of milk that costs $3 today might cost $3.50 next year due to inflation. If wages do not increase at the same rate as inflation, individuals may struggle to maintain their standard of living. This makes investing and financial planning essential to protect wealth from inflationary pressures.

According to the U.S. Bureau of Labor Statistics (BLS), the inflation rate fluctuates due to various factors, including supply chain disruptions, government policies, and changes in consumer demand. To mitigate the impact of inflation, individuals should focus on financial strategies such as:

- Investing in assets that historically outpace inflation, such as stocks and real estate.

- Diversifying income sources to ensure financial stability.

- Regularly reviewing and adjusting their budget to account for rising costs.

Interest Rates and Financial Decision-Making

Interest rates, which are determined by central banks such as the Federal Reserve (Federal Reserve), play a significant role in personal finance. When interest rates are low, borrowing money becomes cheaper, making it an ideal time for major purchases such as buying a home or financing a business. However, when interest rates rise, borrowing becomes more expensive, and individuals must carefully consider their financial decisions.

Higher interest rates also impact savings accounts and investment returns. While borrowers may struggle with increased loan costs, savers benefit from higher returns on savings accounts and fixed-income investments. Understanding how interest rates fluctuate allows individuals to make strategic financial choices, such as refinancing loans when rates are low or adjusting investment portfolios based on changing market conditions.

Economic Cycles and Their Influence on Financial Planning

The economy operates in cycles, alternating between periods of expansion and contraction. These economic cycles affect employment opportunities, wage growth, investment returns, and overall financial security.

- During economic expansion, businesses grow, job markets strengthen, and consumer spending increases. This is an ideal time for individuals to invest, start new ventures, and save for future financial goals.

- During economic recessions, job losses, market volatility, and reduced consumer spending can lead to financial uncertainty. Having an emergency fund and a well-diversified investment portfolio can help individuals weather economic downturns.

Understanding economic cycles enables individuals to make proactive financial decisions, such as adjusting investment strategies, increasing savings, and managing debt effectively during different phases of the economy.

The Importance of Financial Literacy in Economic Decision-Making

Financial literacy, or the ability to understand and apply financial concepts, is essential for navigating economic changes. Individuals who are financially literate are better equipped to manage their money, plan for the future, and avoid common financial mistakes.

Studies by the Financial Industry Regulatory Authority (FINRA) show that individuals with higher financial literacy levels tend to make better financial decisions, including budgeting effectively, investing wisely, and minimizing debt. Financial education helps individuals understand:

- How economic factors impact their financial well-being.

- The importance of saving and investing for the future.

- Strategies for managing risk and uncertainty in financial planning.

By improving financial literacy, individuals can make informed economic decisions that contribute to long-term financial stability and success.

Conclusion

Economics and personal finance are closely connected, as economic conditions shape the way individuals earn, spend, save, and invest money. Understanding economic principles such as inflation, interest rates, and economic cycles enables individuals to make smarter financial decisions and adapt to changing market conditions.

By staying informed about economic trends, improving financial literacy, and applying sound financial strategies, individuals can secure their financial future. Whether it is planning for retirement, managing debt, or investing in the stock market, knowledge of economics empowers individuals to make proactive and informed financial choices.

For expert financial planning resources and insights on managing money in a changing economic landscape, visit ELVT Financial.